Health care is a dynamic industry. Continual evolution in policy, medical advancements, and consumer trends means change is a constant. Government programs are often the test ground for some of the most innovative strategies in health care. This is driven, in large part, by the need to find sustainable solutions to complex medical, social, and societal challenges with limited resources.

UnitedHealthcare Community & State has been partnering with states for more than 40 years. During this time, we’ve learned a lot about our partners’ goals, challenges, and opportunities. We’ve seen how collaboration on program design creates success. We’ve also learned a lot from those we serve or seek to serve.

This report highlights findings from extensive consumer research with individuals across the country who are eligible for Medicaid or enrolled in Medicaid. Many of these individuals aren’t members of UnitedHealthcare Community Plan.

1 in 5 Americans are covered by Medicaid. 3 in 5 Americans say Medicaid is important to them.

We all want the same things.

Everyone wants health care to be simple. We all want to get the care we need when we need it. We all want to live a healthy life. Our desires are the same, but achieving these goals looks different for each of us. For those living with the constant stress of financial instability, achieving these goals can be even more difficult.

For people with limited income, Medicaid provides coverage for health services that they otherwise couldn’t afford. Covering 1 in 5 Americans, Medicaid serves many low-income children, adults, seniors, and people with disabilities.1 According to a 2017 Kaiser Foundation poll, nearly 3 in 5 Americans say Medicaid is important to them and their family.2 For many, coverage provided through government programs — specifically Medicaid — provides peace of mind.

What's important to Medicaid beneficiaries?

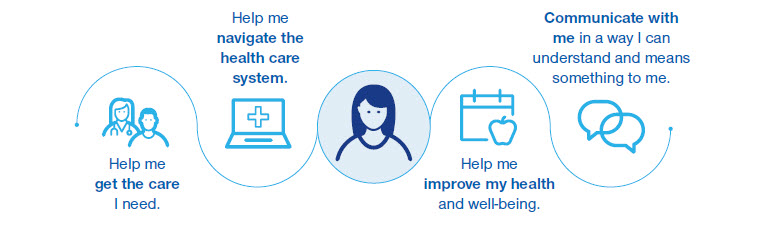

For people with limited income, the economic and social barriers to getting care and achieving good health can be significant. What’s most important to people who have Medicaid? What they tell us is similar to any other population:

Help me get the care I need.

Having coverage doesn’t mean an individual can get care. Lack of coverage is a primary barrier. But other factors also play a role. These include provider availability and willingness to accept Medicaid patients. Competing demands on time and resources (such as childcare or work) and lack of transportation are other obstacles.

"Now I have a doctor for my son through Medicaid...it's been very helpful knowing that if something happens with him I can just go to a doctor without having to be scared that it's going to pull me into debt.3"

The drawbacks of fee-for-service.

Traditionally, Medicaid, like most of the health care system, purchased care for individuals by paying for a particular service or treatment. This method of payment is called fee-for-service (FFS). Providers are paid directly for each service or treatment they deliver.

FFS has been part of Medicaid, Medicare, and private insurance for years. But focusing on the financial transaction is not conducive for improving health or preventing overuse. The FFS model contributes to rapidly increasing health care costs without providing any incentive to improve patient health. Rather, FFS puts the burden on individuals and families to coordinate and manage their own health care decisions and FFS provides few options for states and taxpayers to improve health outcomes with limited financial resources.

The advantages of Medicaid managed care plans.

Instead of relying on the outdated FFS model to provide care for Medicaid members, states are turning to Medicaid managed care organizations (MCOs). Managed care plans like UnitedHealthcare Community Plan offer clear advantages compared to FFS.

Managed care plans:

- Focus on improving overall patient health instead of transactions.

- Improve outcomes by increasing access to care and providing better preventive care.

- Coordinate care providers and services for plan members.

- Make the health care experience less complicated and intimidating.

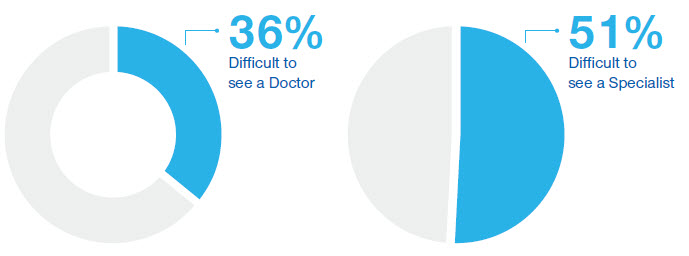

In our primary research among Medicaid consumers not currently enrolled in UnitedHealthcare Community Plan, more than one third (36%) indicated that it’s not easy to make an appointment to see a doctor.4 This number increases to more than half (51%) when it’s a health care specialist.5 Additionally, nearly 1 in 5 (19%) Medicaid consumers strongly feel they need help getting to/from medical appointments.6

How hard is it to get care?

Making it easier for members to find and get to providers is a critical issue for Medicaid managed care programs. Success means more than just a better consumer experience. It means creating new health care consumers — consumers who are engaged in their health care decisions, who access vital preventative care services, and who rely less on high-cost emergency rooms for routine care.

Some individuals have learned that the fastest way to get to providers and specialists is through the emergency department. At UnitedHealthcare Community Plan, we put a lot of effort into creating other avenues to care and providing help to schedule appointments. As a result, we’re improving usage patterns and saving valuable ER resources for true emergencies.

"I've received referrals from my PCP and tried to get appointments, but can't. I finally go to the ER where I know I will get a good specialist.7"

Medicaid beneficiaries feel like second-class citizens.

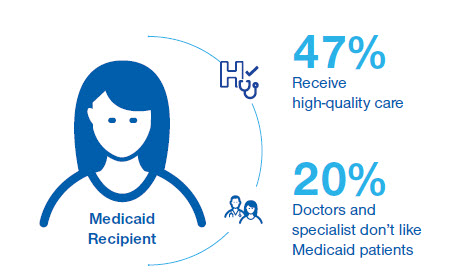

Beneficiaries consistently express concern that their access to high-quality care is limited. Less than half (47%) of Medicaid consumers we surveyed say they receive high-quality care.8 Consumers also feel that they are treated as second-class citizens in the primary care system. When asked if doctors and specialists don’t like to take appointments with people on Medicaid, 20% strongly agreed.9 Here’s how one woman described her feelings:

"[People think Medicaid patients] are lower income people, so they don't take care of themselves as they should. They...are lazy and not trying to get better.10"

It isn’t hard to see how these feelings can quickly lead to disengagement and misuse of the health care system. Why would anyone willingly engage with a system that leaves them feeling inferior? They tend not to, unless there’s an immediate need or emergency. This reluctance delays preventive care and seeking treatment until the condition becomes serious.

Poverty undermines health.

Providers, health plans, and states are growing more aware of the connection between poverty and health. Living under constant stress, or in a toxic environment, is a severe detriment to good health. Financial instability, unstable social networks, and/or chronic illness or disability all have an impact. Commonly known as social determinants of health, or SDOH, these issues undermine how our bodies work, our ability to get care, and our capacity to adopt healthy behaviors. By emphasizing whole-person care, managed care plans are well-positioned to support a broad approach and implement a broad range of strategies to address SDOH.

As states develop programs, considerations to improve how individuals find and engage with providers include:

- Enable a trauma-informed culture of care that ensures health plans and providers are trained and strive to deliver compassionate care. Although this culture may start in health care, it should also connect with other service sectors like criminal justice and education. That way, gains made in one system won’t be eliminated due to a lack of understanding or implementation in another.

- Allow health plans to develop targeted high- performing networks tailored to serve the needs of their members.

- Encourage health plans to pay for value and reward top providers who demonstrate increased quality, willingness to innovate, and ability to meet the needs of those being served (e.g., translation services, culturally preferred providers, and extended office hours, etc.).

- Encourage health plans to invest in providers who are committed to serving the Medicaid population, or who support critical needs like availability of data, expanded hours of service, and resources to address whole-person needs.

- Expand opportunities to pay for telehealth to help increase provider capacity and improve usage.

- Ensure rates appropriately compensate and encourage providers to serve the Medicaid population.

- Provide health plans with the flexibility and resources to connect individuals and families with a full array of services to meet socioeconomic challenges as well as medical needs. This allows health plans to remove barriers to better health.

- Ensure program design is comprehensive, allowing health plans to coordinate an individual’s needs for physical health, behavioral health, and long-term services and supports (LTSS).

Booking an appointment is just the beginning.

For Medicaid beneficiaries, the lack of reliable and affordable transportation is a real challenge that hinders their ability to get medical care. Frequently, Medicaid consumers rely on others to take them to their appointments. This can be due to the distance to the provider’s location as much as not having one’s own vehicle. Given the emphasis managed care plans place on preventive care and routine doctor visits, removing transportation challenges is essential to improving health.

Primary research by UnitedHealthcare shows that nearly 1 in 5 (19%) Medicaid recipients feels strongly that they need help getting to/from medical appointments.11 Measuring the cost of missed medical appointments and visits due to transportation barriers is difficult. However, the issue of transportation comes up time and time again in stories from providers as well as their patients. One provider we interviewed shared this experience:

"One of my patients missed several appointments in a row because he just could not get here on time. By the time he finally made [it]... I was afraid he might lose [his foot]."

Caregivers face even greater challenges.

Difficulties with transportation are compounded when the person seeking care is also a caregiver. What should people who care for another adult or multiple children do with their loved ones while they’re at the doctor? This dilemma is a significant barrier to care. But it’s even more complicated for caregivers who rely on non-emergency medical transportation. Many times, program policy prohibits them from bringing anyone with them on the bus or in the taxi or van.

As states develop programs to reduce transportation challenges, considerations should include:

- Ensure coverage for non-emergency medical transportation.

- Give health plans and care coordinators the flexibility to allow transportation of other family members.

- Provide respite or day care services that caregivers can use when they seek care.

- Encourage providers to offer an on-site care option and/or family-friendly waiting rooms and services.

- Use transportation as a way to improve access to non-medical services like workforce training, housing supports and nutritional services.

"There are plenty of round trips and being able to bring my kids with me would definitely get me to the doctor more often.12"

Help me navigate the care system.

The health care system is complex. It can be difficult for anyone to understand and navigate. Many Medicaid consumers are overwhelmed and unsure how to find their way, and there are a few key reasons why they have trouble navigating the health care system in America.

It's hard to do what you don't understand.

Compared to commercial and Medicare populations, Medicaid consumers are the least likely to say they can explain a variety of health care terms.13 Until recently, terms like “copay” and “deductible” were relatively rare in the Medicaid landscape. However, increasingly, states are exploring and implementing copayments, premiums, and health savings and health reimbursement accounts. These “commercial-like” strategies help get consumers become financially engaged in their care.

77 million American adults have basic or below health literacy

Education levels and literacy rates hinder understanding of complex concepts. According to the US Department of Health & Human Services, more than one- third of U.S. adults, or 77 million people, would have difficulty with common health tasks, such as following directions on a prescription drug label or adhering to a childhood immunization schedule using a standard chart.14 Education is a key factor for predicting health literacy. As a result, the Medicaid population faces notable challenges in understanding the complexity of the health care system. Unfamiliarity and low health literacy makes it harder to access services, gather information and make decisions. This, in turn, can lead people to either opt out of preventive care or misuse emergency room services.

"I've been on Medicaid a long time and I don't know anything about it. I'd like someone to teach me. Tell me. I've been trying to understand it.15"

Complex needs complicate care.

The health care system itself is complex. However, Medicaid recipients often have to navigate a variety of programs, agencies and rules. The complexity of Medicaid regulations and program design can make it unnecessarily difficult for enrollees. Fragmented benefit design means individuals get behavioral health from one health plan, physical health services from another, and long-term services and supports (LTSS) from a different agency. This is inefficient, frustrating, and results in poor outcomes. Nearly 1 in 5 Medicaid consumers state that it’s difficult to figure out who to call when they have questions about Medicaid insurance.16

Nearly 1 in 5 Medicaid consumers don't know who to call with questions.

The challenge of navigating the system increases with the complexity of the needs of the person seeking care. It’s common for individuals with disabilities and the elderly to have complex care needs. Complex conditions often lead to functional limitations and cognitive challenges.

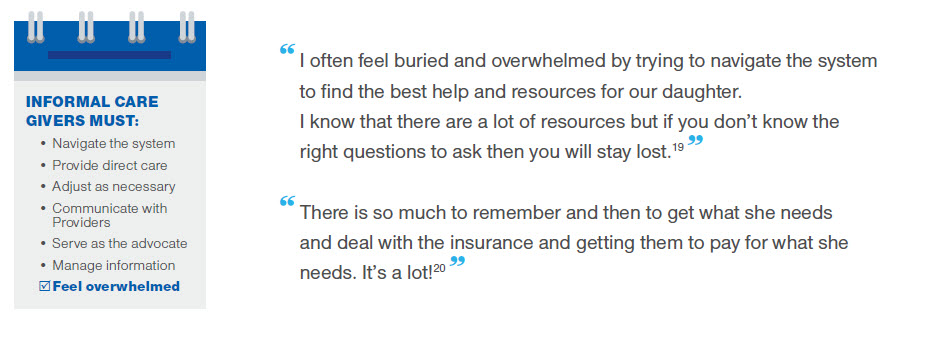

Family caregivers, or natural supports, manage much of the care for Medicaid consumers with complex conditions. According to the National Center on Caregiving, of family caregivers who provide complex chronic care, 46% perform medical and nursing tasks, and all provide help with activities of daily living.17 In addition, caregivers shoulder the responsibility to adjust care, communicate with health care professionals, and serve as an advocate with providers, community services, and government agencies. Despite the broad range of services available, caregivers are forced to handle everything from navigating the system to providing direct care, all while managing the details of the individual involved. These caregivers are overwhelmed by the system and don’t know where to go. They worry that their lack of knowledge is keeping their loved ones from getting the care they need.

- Care coordination helps reduce the burden and ease anxiety for caregivers. By helping to keep track of medications, appointments, and social services, etc., the extra support care coordinators provide can be invaluable.

"She sees so many specialists and they all seem to give her different medications. It feels like I am the only one who makes sure they don't have adverse reactions with each other.21"

Caregivers are unanimous in their desires. They want a consumer advocate who helps them navigate the system, helps with the overwhelming administration of paperwork, and coordinates the various services. Ultimately, caregivers want help to secure the best care for the person they care for. By providing effective care coordination, managed care plans are working to make life easier for caregivers as well as members.

"I want them to guide me through the process. Do things like have check points for immunizations, develop a plan of care for his entire life and help navigate us through the process in general...and help with all the paperwork.22"

As states develop programs that support individuals in navigating the health care system, considerations should include:

- Integrate benefits under a single contract to ensure a single point of contact for individuals, reduce administrative duplication, and eliminate cost shifting within the system.

- Leverage managed care to deliver care coordination — especially for populations with complex medical, social, functional, and behavioral health needs.

- Factor non-traditional providers, such as peer supports, into program design.

- Consider avenues to support and develop caregivers as they are a critical part of the care team.

Help me improve my health and well-being.

Even $1 - $5 fees can lower use of care

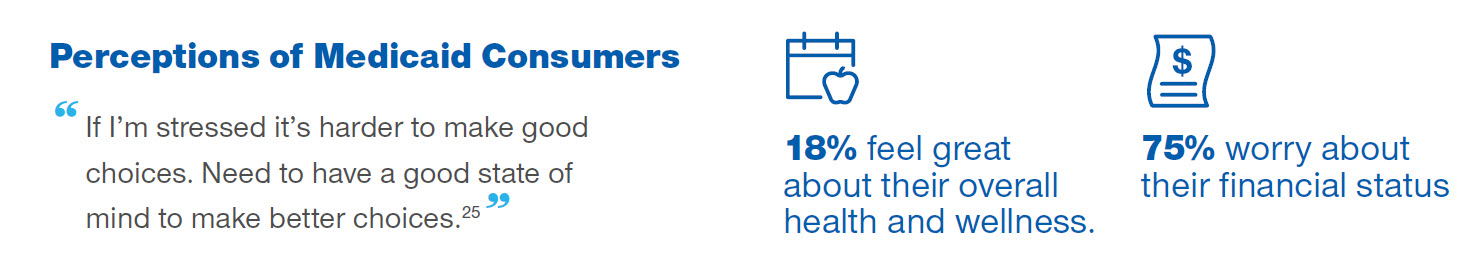

Many Medicaid consumers — like many Americans — aren’t satisfied with their health status. Consumer research shows that only 18% of Medicaid consumers feel “great” about the overall state of their health and wellness.23

Medicaid consumers are aware of the limitations that impede their ability to make good choices and become healthier. Not surprisingly, the main barriers they face are time and money. The vast majority (75%) of Medicaid consumers indicate that they worry about their financial status.24 Circumstances dictate choices and trade-offs individuals and families must make. The life situations, stress, and scarcity of personal and community resources combine to have harmful effects on health.

Little money. Tough Choices.

For those with limited income, decisions driven by lack of money can result in missed care. When there are other more pressing costs and bills, skipping health care is often seen as a necessary choice. As one Medicaid consumer explained, he went to a pharmacy to pick up a prescription, but because it cost $100 he left it at the store.26 Another Medicaid consumer put it this way:

"No one should have to choose [between] 'Should I pay my light bill or my medication."

Medication isn’t the only thing Medicaid consumers will skip. Many also postpone or ignore doctor visits entirely until circumstances become dire.

"I will wait until I am about to explode before I see a doctor for myself. I will then go to the ER.27"

In the budgets of most individuals and families served by Medicaid, there is little or no room for extra expenses. Even minimal costs for medical expenses are considered in terms of necessity. According to a Kaiser research brief, even $1-$5 cost-sharing for Medicaid consumers are associated with reduced use of care.28 Choices in the moment take precedence, and saving is difficult to do — though Medicaid consumers recognize its importance.

"Payday...goes just as quick as it comes. After insurance, car note, mortgage, utilities, groceries we have about $150 a week. That's not including credit cards or gas for our cars. We have exactly $1 in savings. But we make it and it's actually all right.29"

The struggle to save for the future worries many — particularly because there is no buffer for unexpected expenses. Consumers are unprotected against a major crisis.

"I am stressed out and I am not stable. I feel stressed because I know there is no money [in savings]. I do not know what will happen in the future.30"

Financial stability is their #1 desire.

3 in 10 lower-income workers don't want to take time off to get care.

The U.S. Financial Diaries Project looks at how low- and moderate-income families manage their finances. The study shows that financial stability is paramount. When asked to choose whether “financial stability” or “moving up the income ladder” is more important, 77% of participants chose “financial stability.”31 In-depth analysis reveals that low-income households often juggle multiple jobs and incomes. Having many income sources with different pay cycles and consistency creates uncertainty about how much money they’ll have and when it will arrive.

"[Finances]...cause me suffering. I constantly think of what I will do to make money and if I will have enough fortitude to keep them up.32"

Low-income households use a variety of tactics (credit cards, pawning household items, etc.) to get through periods with no income. This also creates a lifestyle in which purchases and investments become a series of trade-offs. Budgeting becomes a day-to-day — or even hour-to-hour — exercise.

"Some of the financial decisions that get made day-to-day, would be what bills can be afforded at the particular time and what extensions need to be made... I weigh out the options and the effects it would have on us financially, as well as emotionally. And, make a decision as to what is more important at that particular moment.33"

The implication for health care, as stated previously, is that it’s often de-prioritized. A Pew Research Center poll found that 3 in 10 lower-income workers aren’t able to take medical leave when needed due to concern over loss of wages or salary.34 More pressing needs and bills mean that trade-offs consumers are constantly making can be at the expense of health, and can include skipping medication, delaying surgery, or choosing the least-costly route.35

"[A trade-off I've had to make is] getting my teeth pulled...I have $500 to get my teeth fixed. I will get $150 to just get them pulled. It is just cheaper to get it that way.36"

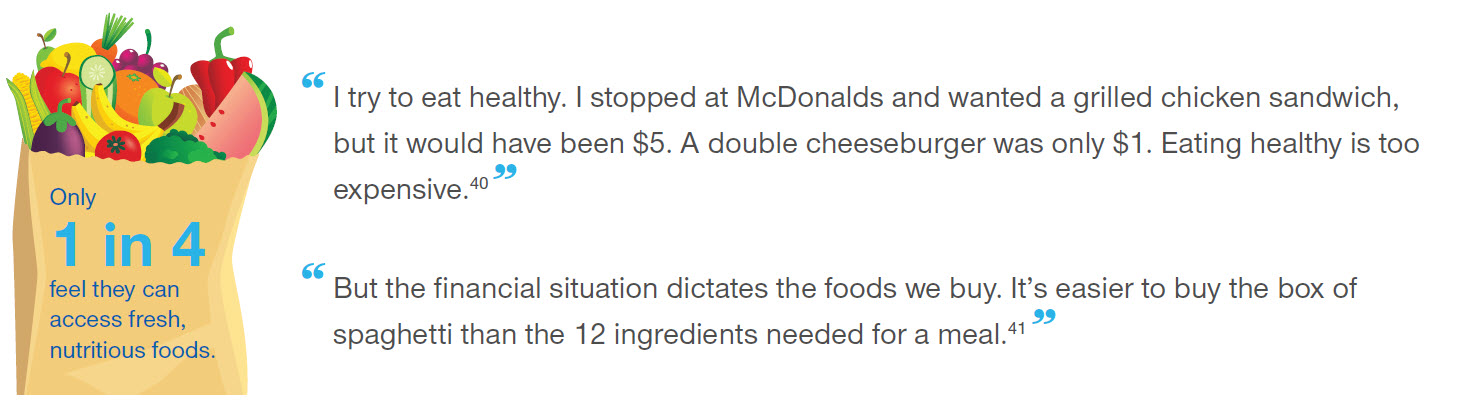

Beyond forgoing care, financial and time constraints often lead to unhealthy eating and activity. Additionally, access to healthy, nutritious food is a challenge for many. Only 25% of Medicaid consumers feel that there are places to buy fresh, nutritious food in their neighborhoods. More than 77% eat fast food every week.39 Many times, difficulty in affording and accessing fresh produce leads to making unhealthy food choices.

Furthermore, 25% of individuals surveyed state they never exercise.42 Respondents clearly understand the benefits of exercise and acknowledge its importance. However, they see it as a luxury they simply don’t have the time to pursue.

"I have to put off surgery for my other foot. It would leave me immobile for 7 weeks and that is not an option right now. Until it is absolutely necessary I am going to have to put that off...with the money deal it's not enough.37"

Strategies to better support those with limited means.

What can health plans do to help people with limited time and money pursue better health? Respondents pointed to tangible benefits like financial incentives (such as providing funds for health products, financial rewards for healthy behaviors, and access to grocery deals). Providing individualized services to help navigate the health care and human services systems was another popular concept. The idea of having advocates and guidance resonated with those surveyed.

People were less interested in online programs and education tools. They recognized the benefits of having access to weight loss programs, support networks, and healthy recipes. But lack of time was cited as a reason for lack of adoption.

As states develop programs that seek to foster consumer engagement and improve outcomes, considerations should include:

- Strive for simplicity while creating meaningful and flexible incentives that encourage positive changes in behavior.

- Include incentives to reward healthy behaviors and purchasing decisions.

- Allow for flexibility to structure meaningful incentives based on the profile of enrollees, desired behavior changes, and in alignment with state goals. Flexibilities should include but not be limited to creative incentive models. (Examples would be giving people the chance to earn money to cover the GED exam fee or secure stable housing.)

- Allow for adjustments to benefits, educational tools, and responsibility as individuals move up the income scale.

- Leverage a financial management tool as the platform. The account should serve as an educational tool to build financial literacy, increase accountability for care spending decisions, and develop a stronger acumen for purchasing and paying for health care.

- Develop capacity to support real-time information tracking and sharing between Medicaid, income, tax and finance offices, as well as health plans.

- Align reimbursement and financing of stakeholder agencies and programs to better support and further the larger, shared goal of addressing social determinants of health (SDOH).

Communicate with me in a way I can understand and means something to me.

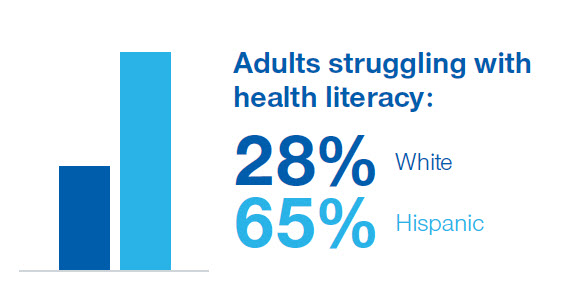

Language and cultural differences often compound the challenges of health literacy and communication. For example, Hispanic adults (68%) are much more likely to have difficulty with health literacy than white adults (28%). This disparity shows how language and culture impacts the ability of states, health plans and providers to connect and successfully engage individuals in health.43

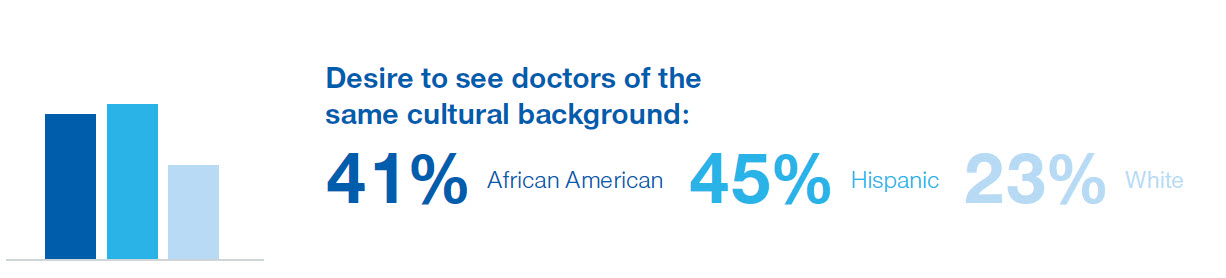

Culture affects how people understand, communicate, and respond to health information, and can contribute greatly to health literacy.44 Among those served by Medicaid, 45% of Hispanics and 41% of African Americans indicate that it’s important for them to have doctors of the same cultural background. That’s compared to 23% of non-Hispanic white consumers. A deeper dive into the data shows that individuals who are Hispanic or Asian look for in-culture doctors for personalized attention. African Americans, however, seek in-culture doctors for expertise with diseases prevalent in people of their background.45

A strong connection between individuals and their preferred providers is critical to ensuring engagement in care and health. In recent UnitedHealthcare research, Medicaid beneficiaries were asked to rank sources of information they could use when considering ways to become and stay healthy. When individuals ranked these information sources from the most to least trustworthy, the primary doctor emerged as the most trustworthy source, followed by specialist doctors. This aligns with Gallup research, which shows that medical professionals are highly respected. Nurses were rated highly for honesty and ethics by 80% of Americans, and 65% rated medical doctors and pharmacists highly.46

However, due to the access and cost issues noted previously, 47% of people served by Medicaid do not have a regular primary care provider.47 As a result, most interactions with providers tend to be symptom-focused rather than focused on preventative care or overall health management.

47% of Medicaid beneficiaries do not have a regular doctor.

It’s imperative to build high-performing networks that align with the preferences and needs of the population being served. Managed care plans help connect individuals to those providers and help establish relationships that encourage continued engagement. Coordinating with community partners helps leverage and integrate resources, advice, and education from other non-provider sources.

Where do health plans fit in?

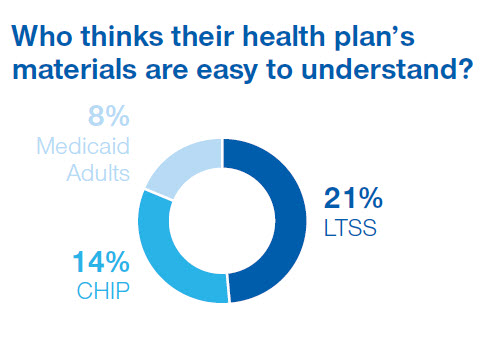

Unfortunately, for most, a “Medicaid insurance company” is not seen as a go-to resource for health and wellness.48 While some of this is based on a historic perspective on the role of a health plan, health insurers have significant opportunities to improve the way they share information. When asked if their health plan gives them materials that are easy to understand, only 21% of individuals receiving LTSS, 14% of families served by CHIP, and 8% of adult members agreed.49

Adopting reading level guidelines and translating materials into different languages is good, but it’s not enough to bridge the gap between what people want and need to know and what they’re able to learn from health plans and providers. Financial and social barriers also prevent low-income families from getting care. Better, more culturally competent information and connections can help these families use the health care system appropriately and improve their quality of life. Outcomes and health literacy are more likely to improve when individuals interact with a health system that’s person-centered, welcoming, and communicates in ways Medicaid families can understand.

As states develop programs that support clear communication, considerations should include:

- Design programs as simply as possible and be clear with individuals about the role of health plans, the state, and providers.

- Encourage diversity in staff at health plans, health systems, and state program leadership.

- Foster person-centered health care systems from state requirements through to provider practices

What's next?

To design programs, policies, and services that improve outcomes, it’s critical to understand the day-to-day pressures and perspectives of those who rely on Medicaid. Engaging individuals in care requires a deep understanding of the barriers that limit engagement and the motivations that sustain positive and healthy relationships.

UnitedHealthcare Community & State is committed to collaborating and designing solutions that are informed by the voices of those we serve. We strive to make communication simple and clear, and make interacting with us easy for our members. We know that by working together we can create healthier individuals, healthier families, and healthier communities.

References